The IETU Tax Mexico

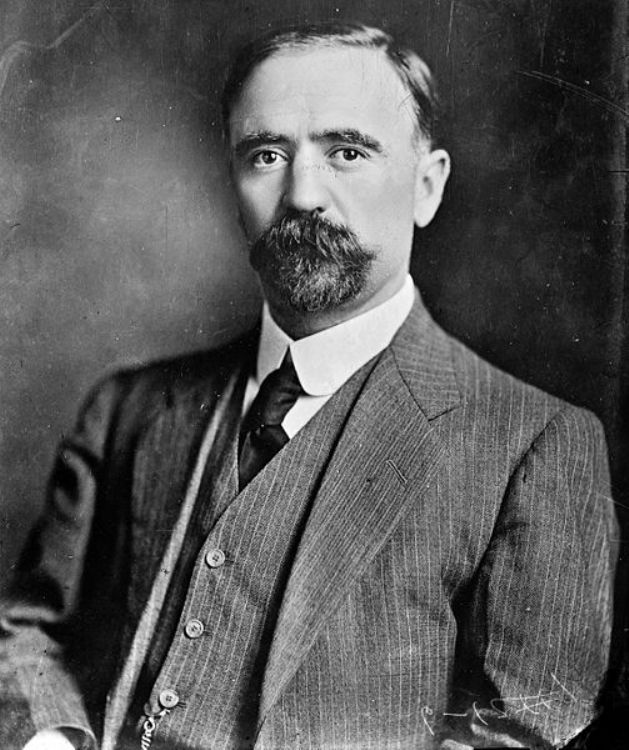

The Business Tax to Unique Rate (Impuesto Empresarial de Tasa Única or IETY) was approved by the Congress of the Union in June 2007 as part of the Fiscal Reform proposed by President Felipe Calderón and went into effect on June 1, 2008.

The IETU rate that must currently be paid to the Mexican government is 16.5% of the income obtained minus the proper deductions. The income considered to calculate this tax is the one effectively received during the particular fiscal exercise in accordance to the law of IVA (Impuesto al Valor Agregado).

Obligated to pay this tax are all those physical and moral persons residing in Mexico, as well as those living abroad but permanently established in this country, for the income obtained, not matter where that income was received for the transfer of goods, independent services and granting the use or temporal benefit of goods.

This income will accumulate for calculating IETU when it is effectively collected. All expenses can be deducted, except for the concept of salary, Rent Tax (ISR), interests derived from contracts of loans, financing or financial lease and the contributions to social security.

The Minister of the Treasury Department, Agustin Carstens, has stated this tax has been fulfilling its goal by stimulating investments, creating more jobs and a great economic growth. Although it was designed together with the private sector, some business groups and transport operators are displeased. The head of Treasury Department is sure IETU promotes investments in the country and was a determining factor for the investment rate to reach 10% during February 2008.

The income exempt from the IETU is the one obtained by Federal Entities, Municipalities, autonomous constitutional organs and semi-public administration entities. Also exempt are the parties, associations, unions and civil organizations with scientific, political, religious and cultural goals. Also, this tax doesnât apply to agricultural, livestock and fishing activities.

The new IETU Law estimates 100,000 million pesos per year received in taxes, through which it attempts to avoid tax havens and tax evasion. IETU will tax the difference between income and expenses on intermediary goods, with rates of 16.5% in 2008, 17% in 2009 and 17.5% in 2010.

Artículo Producido por el Equipo Editorial Explorando México.

Copyright Explorando México, todos los Derechos Reservados.